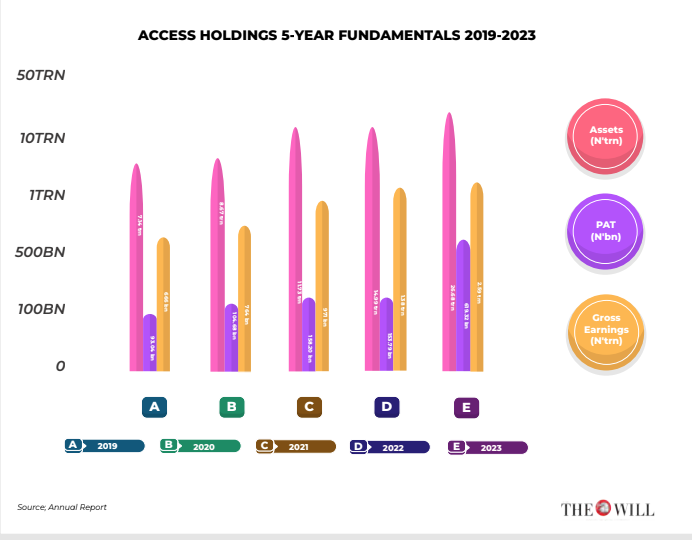

April 1, (THEWILL)- In an unyielding bid to maintain the lead in Nigeria’s banking industry space, Access Corporation Plc recorded a 78 percent growth in assets, which rose to N26.68 trillion in 2023 from N14.99 trillion in the prior year. This remarkable balance sheet growth consolidates the group’s status as the largest financial services institution by assets which it has maintained over the years.

The impressive performance accrued from various segments of the group’s operations which reflected sterling results amid a challenging environment that triggered punching headwinds in the economy.

The group last week reported N729 billion profit before tax (PBT) in its financial results and accounts for the full year ended December 31, 2023, a significant increase of about 335 percent from the N167.68 billion reported in 2022.

The Tier-1 financial services institution also declared N619.3 billion profit in 2023, the last financial year in which the late Group CEO, Dr. Herbert Wigwe was at the helm of affairs. This represented an increase by 307 percent compared with the N152.2 billion reported in 2022.

The significant increase was also part of the foreign exchange revaluation windfall enjoyed by the banks, following the unification of the foreign exchange market in June 2023. Access Corporation reported N628.93 billion foreign exchange gain, reflecting a growth of 87.44 percent from the N335.55 billion reported in 2022.

The group also recorded significant growth at both net interest incomes of N555.8 billion and net fee income of N207.7 billion revenue lines. while fair value gains on non-hedging derivatives, equity investments and fixed income securities brought in a further N512.3 billion.

The impressive performance comes on the heels of raging inflation among other economic headwinds which have made business activities more challenging

Deposit from customers increased by 65.62 percent YoY to N15.32 trillion from N9,25 trillion (Dec 2020: N4.9 trillion) reaffirming the group’s strong market access and robust funding base reflected in the expansion in loans and advances to customers which rose to N8 trillion from N6.1 trillion in the previous year, reflecting an increase of 31.6 percent.

THEWILL had reported that the group’s Q3 robust performance mirrored acceleration towards the 2023 targets as contained in its five-year strategic plan (2023-2027).

It also underlines the group’s corporate strategies in forming a holco structure two years ago (March 2022) during which it recorded enhanced expansion that would consolidate its grips on industry leadership as Nigeria’s largest quoted firm by assets.

At the presentation of the five-year strategic plan in Lagos in January 2023, the then Group Chief Executive Officer (CEO), Access Corporation, Mr Herbert Wigwe, emphasised that its expansion programme would be driven by technological innovation. Apparently to maintain its industry leadership narrative.

“By the end of 2027, we expect to be in at least 26 countries and in at least 3 Organisation for Economic Co-operation and Development (OECD) countries supporting trade (in the United Kingdom, France and the United States of America).

“The customer acquisition drive to hit 100mn for the Retail Business by 2027 will continue, as we emigrate the majority of customers to digital platforms by 2027 across touch-points.”

He added, “We want to be a global player with African heritage. We are a growth-oriented organisation and we will continue to invest in our people amid changes.”

Access Corporation closed its last trading day (Thursday, March 28, 2024) at N24.50 per share on the Nigerian Exchange (NGX), recording a 2.1 percent gain over its previous closing price of N24.00. Access began the year with a share price of N23.15 and has since gained 5.83 percent on that price valuation..

Access Holdings is the third most traded stock on the Nigerian Exchange over the past three months (Jan 2 – Mar 28, 2024), It has traded a total volume of 1.93 billion shares—in 36,754 deals—valued at N48.3 billion over the period, with an average of 30.6 million traded shares per session. A volume high of 117 million was achieved on January 10th, and a low of 6.07 million on February 13th, for the same period, according to data from the NGX.

The Board of Directors of Access Holdings on February 13, 2024 had announced the appointment of Ms Bolaji Agbede as the Acting Group Chief Executive Officer of the Company, following Wigwe’s tragic demise.

In like manner, pioneer Group Managing Director/CEO of Access Bank Plc., Mr Aigboje Aig-Imoukhuede, was recently appointed Chairman of Access Holdings.

Wigwe owned 2.58 billion direct and indirect shares in Access Holdings, equivalent to 7.27 percent of the bank as at the end of 2023.

About the Author

Sam Diala is a Bloomberg Certified Financial Journalist with over a decade of experience in reporting Business and Economy. He is Business Editor at THEWILL Newspaper, and believes that work, not wishes, creates wealth.