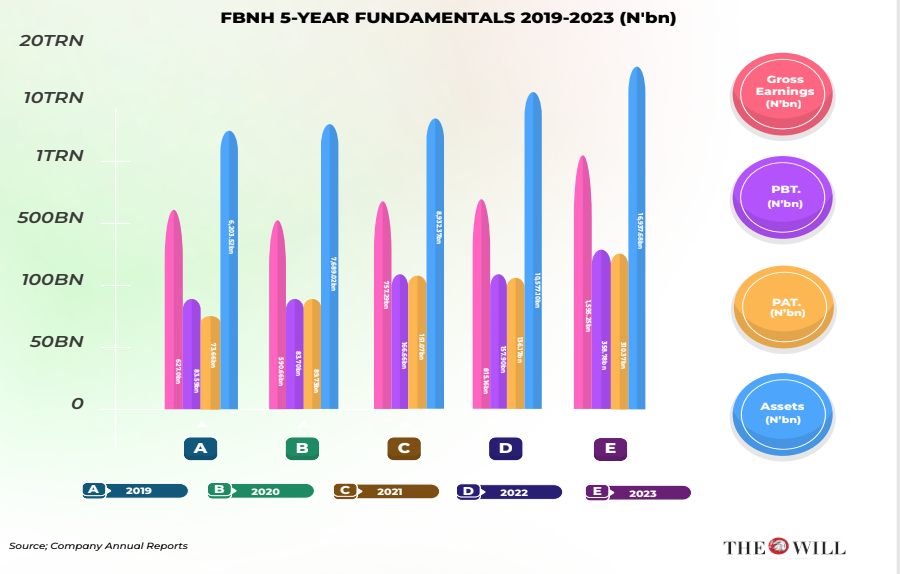

May 27, (THEWILL)- Despite incessant corporate governance hiccups amid a challenging operating environment, FBN Holdings, the parent company of FirstBank of Nigeria Limited, posted amazing triple-digit bottom-line growth in 2023. The group also announced a 95.6 percent remarkable increase in gross earnings hitting N1.59 trillion from N815 billion recorded in the preceding year.

According to the audited financial results for the 2023 financial year presented to the Nigerian Exchange (NGX), this impressive performance in gross earnings resulted in a Year-on-Year (YoY) growth of 126.86 percent in Profit Before Tax (PBT) from N157.9 billion in 2022 to N350.59 billion in 2023.

Profit After Tax (PAT) also recorded triple-digit growth of 128 percent from N136.1 billion to N310.37 billion in the period ended 31 December, 2023.

The increase in gross earnings is primarily due to growth in interest and non-interest income. Interest income increased by 74 percent from N551.93 billion in 2022 to N960.32 billion in 2023. Non-interest income grew by 319.2 percent from N230.65 billion to N966.89 billion in the same period.

Similarly, the increase in interest income is attributed to the growth in the size of risk assets and their effective repricing, alongside the rise in the yield of other interest-bearing instruments over the year.

FBN Holdings harvested a remarkable increase in electronic banking revenue which yielded the Group N66.34 billion against N55.09 billion recorded in 2022, constituting a 20.4 percent increase.

Growth in non-interest income was driven by significant trading gains. The group lost a whopping N332.78 billion from the revaluation of foreign currencies an area its peers harvested a windfall.

Interest expense grew from N188.68 billion in 2022 to N411.41 billion in 2023 due to the high interest rate environment.

Notwithstanding the 50 percent growth in operating expenses in 2023 (from N228.51 billion in 2022 to N341.85 billion), the Group’s bottom-line improved significantly (by 128 percent) due to improved top-line performance.Yahaya Bello vs EFCC

The Group has continued to deepen its stronghold in key corporate and retail deposit segments as customer deposits increased by 50 percent from N7.12 trillion in the previous year to N10.66 trillion in 2023. Its retail drive continues to yield dividends as customers’ deposits now constitute 692 percent of total deposits (N12.466 trillion) also reinforcing increased customer confidence in the Group’s brand as Nigeria’s oldest financial services institution.

Total assets increased by 60 percent from NGN10.57 trillion in 2022 to N16.93 trillion in 2023, largely due to growth in total deposits despite the loss in the revaluation of foreign currency deposits.

Gross loans grew by 68 percent from N5.0 trillion in 2022 to N8.4 trillion in 2023 partly due to the revaluation of foreign currency loans and the growth in local currency risk assets.

As a result of the disciplined and diligent approach to risk assets creation and management, a whopping N227.41 billion impairement charges was made by the Group for the N8.4 trillion gross loan as against N68.61 provided for the N5 trillion gross loan in the previous year.

This will ensure that the loan growth does not impact the Non-Performing Loans (NPL) ratio. It will also and prevent the Group from returning to the old sad days of heavy-footed NPLs that dragged growth significantly and sent the Group to the rear position in the industry.

This is an attestation to the Group’s resilience despite headwinds and a challenging macroeconomic environment while it battled internal corporate governance wrangling.

As a demonstration of its commitment to shareholders, the Group has announced a proposed dividend payout of N0.40 per share which amounts to N14.36 billion for the year ended December 31, 2023.

The Group is undertaking urgent necessary actions to meet the new minimum N500 billion equity capital requirement for banks with international authorisation within the timeframe stipulated by the Central Bank of Nigeria (CBN). This will strengthen its presence in key markets to continue positioning for sustainable growth and value addition for stakeholders.

FBN Holdings closed its last trading day (Friday, May24, 2024) at N20.45 per share on the Nigerian Exchange (NGX), recording a N9.3 drop from its previous closing price of N22.55. FBN began the year with a share price of N23.55 but has since lost 13.2 percent off that price valuation.

FBN Holdings is the seventh most traded stock on the Nigerian Exchange over the past three months (Feb 20 – May 24, 2024). FBNH has traded a total volume of 965 million shares—in 21,950 deals—valued at NGN 30.2 billion over the period, with an average of 15.3 million traded shares per session.

A volume high of 75.1 million was achieved on March 22nd, and a low of 1.71 million on May 8th, for the same period, according to data from NGX.

THEWILL recalls that FirstBank, Nigeria’s premier financial institution and financial inclusion services provider, was earlier in the year announced as the Best Corporate Bank at the recent prestigious Euromoney Awards for Excellence, Nigeria 2023.

The Bank clinched the coveted award based on its 130-year commitment to enabling its corporate customers achieve success through relevant and tailored financial solutions. FirstBank’s continuous investment in technology has been crucial to its leading industry role in optimally meeting the needs of its corporate customers. Recent investments in technology include the development of its smart and interactive Transaction Banking Platform known as FirstDirect2.0.

FirstDirect2.0 provides a one-stop shop online banking platform for corporates, offering best-in-class capabilities such as Payments, Collections, and Account Services, and a locally focused phased implementation of Trade and Supply Chain Finance – a first for the Bank.

The platform offers customers various solutions for corporate cash management (Payments, Collections and Liquidity Management). It will also deliver end-to-end trade solutions for corporate clients covering L/C creation, tracking, bidding and reconciliations.

The Bank’s Corporate Banking model is focused on ensuring that its clients get the same quality of service across the Bank’s geographical locations. The execution of this approach through the deployment of the Global Account Management (GAM) Framework, implemented to enhance cross-relationship management tailored to Customers with a Pan African footprint.

About the Author

Sam Diala is a Bloomberg Certified Financial Journalist with over a decade of experience in reporting Business and Economy. He is Business Editor at THEWILL Newspaper, and believes that work, not wishes, creates wealth.