June 17, (THEWILL)- The value of Nigeria’s exported agricultural products rose significantly in the first quarter of the year (Q1, 2024) by 270.3% to N1.03 trillion, compared with N279.64 billion recorded in Q1 2023, on the back of over 200% devaluation of the Naira in June 2024.

Data from the National Bureau of Statistics (NBS) revealed that exports of agricultural goods increased by 123.08% over the value recorded in Q4, 2023 which was N463.97 billion.

The data showed that the surge in the value of agric exports accounts for the tremendous increase in the value of total trade in agricultural goods during the period.

The NBS in its latest ‘Foreign Trade in Goods Statistics’ repot revealed that total value of trade in agricultural products in Q1, 2024 stood at N1,95 trillion of which exports were valued at N1.03 trillion.

The NBS said that export of agricultural products was dominated by ‘Sesamum seeds’ valued at N247.75 billion, ‘Superior quality Cocoa beans,’ with N230.85 billion and ‘Standard quality Cocoa beans’ with N140.09 billion.

Further analysis showed that ‘Sesamum seeds’ worth N83.29 billion and N58.04 billion were exported to China and Japan, respectively while ‘Superior quality Cocoa beans,’ worth N112.00 billion and N48.28 billion were exported to The Netherlands and Malaysia respectively.

Also, ‘Standard quality Cocoa beans’ worth N58.29 billion and N37.77 billion were exported to The Netherlands and Malaysia, respectively.

“On the other hand, total imports of agricultural goods in Q1, 2024 stood at N920.54 billion or 7.28% of total imports.

‘This is an increase of 29.45% when compared to the value recorded in Q4, 2023 (N711.14 billion) and by 95.28% when compared to the value recorded in Q1, 2023 (N471.39 billion),” the report stated.

The report showed that the major agriculture goods imported in Q1, 2024 included ‘Durum wheat (not in seeds)’ from Canada with N130.26 billion and Lithuania with N98.63 billion.

This was followed by ‘Blue whitings (Micromesistius poutassou, Micromesistius australis – which is a standard fish stock), meat, frozen.’ from the Netherlands vaued at N16.67 billion.

The astronomical increase in the export and import values of agricultural products stem from the massive devaluation of the Naira 12 months ago.

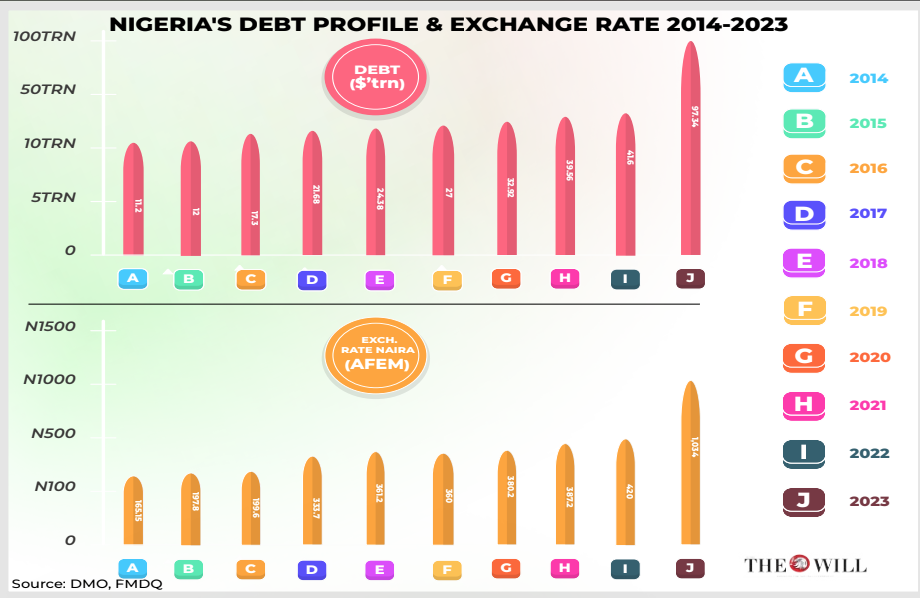

THEWILL reports that the Nigerian naira lost 241.12% of its value in the official market in nine months of devaluation between June 14, 2023 and March 14, 2024 – amid the rollercoaster ride it experienced during the period. Following the floating of the currency in line with President Bola Tinubu’s “bold” market reforms, the naira which traded at N471.67 to a dollar on Tuesday June 13, plunged to N664.04 to a dollar on Wednesday June 14, the first day of the devaluation.

This translated to a 40.78 percent depreciation in one swoop in the official window, while the parallel market dropped from N500 to a dollar to N768 to a dollar.

Nine months after the unification of the foreign exchange market, and floating of the naira, the domestic currency traded at N1,608.98 to a dollar in the official market on Thursday, March 14, 2024, representing a value loss of 241%. The parallel market rate closed at N1,605 per dollar.

During the nine months, the naira plunged to the deepest spot of N1,665.50 to a dollar on February 23, 2024 while the highest turnover of $465.29 was recorded on February 6, 2024 as the Central Bank of Nigeria (CBN) accelerates efforts to boost liquidity in the market.

This is by way of massive borrowing, including the $3.3 billion emergency crude repayment loan secured from Afreximbank by the Nigerian National Petroleum Company Limited (NNPCL) in August 2023 to support the naira and stabilise the foreign exchange market.

On the first anniversary of the floating of the Naira, the local currency closed at N1,452.72 to the dollar on Friday, June 14, 2024, according to data from the FMDQ platform — the aggregator that publishes the Nigerian Autonomous Foreign Exchange Market (NAFEM) rate on a daily basis.

This implies that Naira lost a 207.9% of its value as at date compared with the value the currency traded a day before the floating of the currency.

Inflation rate which adds to eroding the value of the Naira rose from 22.79% in June 2023 to 33.95% in May 2024, representing a climb of 11.16 basis points.

“Usually, devaluation boosts export values because more revenue accrues to the exporters, including farmers and other players in the value chain. On the other hand, high inflation rate compounds the trouble, which means that the exporters are merely carrying volumes of worth-less Naira that earn less in real terms,” said Emmanul Sodeinde, an Agribusiness practitioner.

According to Sodeinde, the hostile operating environment and the unfavourale macroeconomic atmosphere have made agribusiness more or a threat than an opportunity.

“Farmers cannot go to their farms because of insecurity, they cannot easily ship their goods to the market because of bad roads and endless extortion at the roadblocks mounted by security agents as well as attack by residents who loot the goods in trnsit.Exporting from the sea and airports is fraught with corruption and needless protools,” he added.

The devaluation debacle also affected importation of raw materials which has added to the operating challenge of the manufacturing companies, still bleeding from the huge loss from the foreign exchange revaluation

The NBS report showed that the value of total trade of the raw materials sector stood at ₦1,82 trillion in the first quarter of 2024 of which imports were valued at ₦1,46 trillion while exports stood at ₦352.75 billion.

According to the report, the major raw material goods exported were ‘Urea whether or not in aqueous solution’ was exported to Brazil at a value of ₦151.73 billion.

This was followed by exports of ‘Nonmonetary Gold (including gold plated with platinum) in Powder form’ to Switzerland valued at ₦42.43 billion.

“In terms of imports, ‘Cane sugar specified in Subheading Note 2 to Chapter 17, Meant for sugar refinery’ worth ₦235.85 billion was imported from Brazil, this was followed by ‘Other lubricating oils meant to be mixed further’ imported from the United States valued at ₦22.80 billion, while ‘Prep. of milk containing vegetable fats and oils, powdered or granular =12.5kg <=25kg’ imported from Germany was valued at ₦18.00 billion,” the report stated.

The astronomical rise in inflation rate, driven majorly by high price of food, occurred after the CBN had conducted its first Monetary Policy Committee (MPC) meeting on February 26 and 27, where it announced a jumbo hike in interest rate by an unprecedented 400 basis points from 18.75 percent to 22.75 percent.

The devaluation-induced high inflation has hit every sector of the economy resulting in loss of employment and rise in misery index among the citizens.

For instance, the Manufacturing Association of Nigeria (MAN) in its recent report revealed that over 760 manufacturing companies shut down operations while 335 experienced distress in 2023, leading to N350 billion unsold goods.

The group attributed the disturbing development to various economic difficulties, including exchange rate volatility, rising inflation, and a general worsening of the investment climate.

Amid the poor economic climate with weak productive base, experts predict tougher times for the country, with increased borrowing as the way out.

The Economist Intelligence Unit (EIU) in its latest Country Report on Nigeria, highlighted the precarious position of the naira amidst rising inflation and policy decisions that may further affect the currency’s stability.

The report read: “For most of this year, the naira will be highly volatile, leading to regulatory erraticism that can affect businesses, especially those holding foreign currency.

“The CBN lacks the liquidity to support the naira itself; out of US$33bn in foreign reserves, a large share (estimated at nearly US$20bn), is committed to various derivative deals.”

The World Bank has stated that monetary policy tightening by the Central Bank of Nigeria (CBN) may not rein in inflation as anticipated by analysts.

In its recent report titled, “Global Economic Prospects” on the outlook for the rest of 2024 and 2025, the World Bank pegged Nigeria’s economic growth rate at 3.3% in 2024 same as its projection at the beginning of the year.

Furthermore, the bank projected Nigeria’s GDP to grow at 3.5% in 2025.

It explained that growth will pick up from the 2.9% recorded in 2023 due to the effect of the current administration’s reforms in the petroleum and forex exchange sector.

However, the report noted that the failure of monetary policy tightening by the Central Bank of Nigeria (CBN) remains a risk to the outlook. .

The report stated, “Growth in Nigeria is projected to pick up to 3.3 per cent this year and 3.5 per cent in 2025. After the macroeconomic reforms’ initial shock, economic conditions are expected to gradually improve, resulting in sustained, but still-modest growth in the non-oil economy.

“In addition, the oil sector is expected to stabilize as production somewhat recovers.

“Risks to Nigeria’s growth outlook are substantial, including the possibility that the tightening of monetary policy stops short of reining in inflation.”

THEWILL recalls that the Central Bank of Nigeria (CBN) since this year has increased interest rates by a combined 750 basis point

About the Author

Sam Diala is a Bloomberg Certified Financial Journalist with over a decade of experience in reporting Business and Economy. He is Business Editor at THEWILL Newspaper, and believes that work, not wishes, creates wealth.