Investment inflow to the Nigerian economy in the first quarter of this year (Q1 2023) eluded three mainstream deposit money banks (DMBs). According to the National Bureau of Statistics (NBS), no capital was channeled through these DMBs during the period.

The financial services institutions concerned are Heritage Bank Plc, Polaris Bank Limited and Keystone Bank Limited. The NBS, in its ‘Capital Importation Report for Q1 2023’ showed that investors did not choose the affected banks as medium of conveying their investments to their various sector and location destinations.

The NBS latest investment inflow report published Monday, July 10, 2023, showed that, with the exception of Keystone Bank which recorded a total of $2.53 million in 2022, the other two DMBs received nothing last year.

As a result, they appeared in the league of ‘fringe’ players like Suntrust Bank, Coronation Merchant Bank and FBN Merchant Bank who did not feature in the recent NBS report as having contributed to the investment inflow.

On the other hand, Unity Bank Plc, Wema Bank Plc, four-year-old Globus Bank and Jaiz Bank recorded the lowest inflows with $0.11 million, $0.10 million, $0.04 million and $0.01 million respectively in Q1 2023 according to the report under its ‘Capital Importation by Banks’ section.

While Unity Bank received a total of $3.56 million in one tranche in 2022, Wema Bank recorded $3.81 million in three tranches. Globus Bank recorded no investment inflow in 2022.

According to the report in the ‘Categorisation of Capital/ Importation by Banks’ section, Citibank Nigeria Limited ranked top in Q1 2023 with US$424.13 million (representing 37.45 per cent of total inflow).

This was followed by Standard Chartered Bank Nigeria Limited with US$360.33 million (or 31.81 per cent) and Stanbic IBTC Bank with US$151.85 (accounting for 13.41 per cent).

Other financial services institutions with double-digit capital inflow are Zenith Bank Plc ($38.93 million), Rand Merchant Bank ($26.81 million), FCMB Plc ($26.78 million), Union Bank of Nigeria Plc ($21.54 million), Access Bank Plc ($12.60) and FSDH Merchant Bank ($10 million).

An investment banker, Kayode Komolafe, said that subsidiaries of foreign banks operating in Nigeria stand a better chance of attracting foreign capital than their wholly indigenous counterparts.

This is because of the symbiotic relationship between the parent companies and their outposts in other parts of the world as they have a way of relating among themselves to have the capital revolve within.

“The banks that attract the highest foreign investment are subsidiaries of major international financial services institutions who have the money. They are able to attract huge capital within their environment where interest rate is significantly low, inflation rate is also low. So, they borrow at convenient interest rates to invest offshore with prospects of favourable returns”, Komolafe said.

He added that the foreign investors have more confidence in their own banks because of the healthier operating environment than what operates here.

Further disaggregation of the report showed that four states received the highest investment inflows under ‘Destination of Investment’. These are Lagos $704.87 million (accounting for 62.23 per cent of total capital investment in Nigeria in Q1 2023), Federal Capital Territory (FCT) $410.27 (representing 36.22 per cent of total capital inflow).

Others are Akwa Ibom $5.21 million, Adamawa $4.50 million and Anambra $4.00 million.

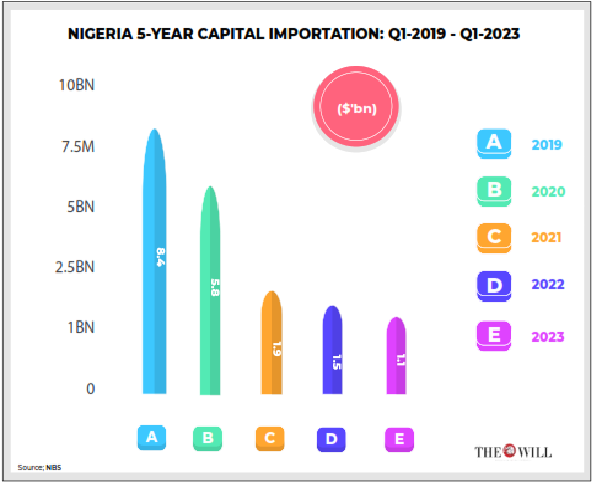

Capital importation into Nigeria has been on the decline in recent times – since 2020 when it dropped to $5.8 billion from $8.4 billion in the previous year. It dipped further to $1.9 billion in 2021, thereafter $1.5 billion in 2022 before sinking to the current US$1,132.65 billion.

“Total capital importation into Nigeria in Q1 2023 stood at US$1,132.65 million, lower than US$1,573.14 million recorded in Q1 2022, indicating a decrease of 28.00% (the figures translated to billions). When compared to the preceding quarter, capital importation rose by 6.78% from US$1,060.73 million in Q4 2022,” the NBS report stated.

The report showed that the largest capital importation during Q1 2023 was received from Portfolio Investment, which accounted for 57.32% (US$649.28 million) of total capital imported in Q1 2023. This was followed by Other Investment with 38.31% (US$435.76 million) and Foreign Direct Investment (FDI) with 4.20% (US$47.60 million).

The significant drop in foreign direct investment has been of concern as it has the real capacity to add value to economic growth through job creation, tax revenue and other impacts. Example is the telecommunication firms.

Disaggregated by Sectors, capital importation into the banking industry recorded the highest inflow of US$304.56 million (representing 26.89 per cent of total capital imported in Q1 2023).

This was followed by capital imported into the production sector, valued at US$256.12 million (22.61 percent), and IT Services with US$216.06 million (19.08 per cent). Consultancy and Agriculture recorded the lowest channel of investment during the period with $0.02 million (0,00 per cent) and $4.84 million (0.43 per cent).

Capital Importation by Country of Origin reveals that investment from the United Kingdom ranked top in Q1 2023 with US$673.64 million, accounting for 59.47 per cent. This was followed by the United Arab Emirates and the United States valued at US$108.28 million (9.56 per cent) and US$95.36 million (8.42 per cent), respectively.

About the Author

Sam Diala is a Bloomberg Certified Financial Journalist with over a decade of experience in reporting Business and Economy. He is Business Editor at THEWILL Newspaper, and believes that work, not wishes, creates wealth.