September 02, (THEWILL) – The admixture of fiscal and monetary policy initiatives impacted considerably on the equities market in the eight months of the year – pushing the All-Share Index to a growth of 30%, year-to-date, as bargain hunters positioned for opportunities and guard against economic uncertainties.

At the close of trading on Friday, August 30, All-Share Index which measures the performance of the market rose to 96,579.54 points against 74,773,77 points it opened with on January 2, 2024 – the first trading of the year, constituting a 30 percent increase.

Market capitalization moved on the same expanding trajectory hitting N55.47 trillion on August 30, compared to an opening figure of N40.91 trillion in January, adding a value of N14.56 trillion to investors amid headwinds that upset the economy at the beginning of the President Bola Tinubu-led government.

On year-to-year disaggregation, the local bourse also recorded a 30 percent jump, from 66,548.99 points to 96,579.54 points, while market capitalization rose to

N55.47 trillion from N36.42 trillion at the end of August 2023 – representing a growth of 52.3 percent,

Although the stock market began the year on a bullish note, various monetary policies converged with fiscal policies to define and redefine the performance of the domestic bourse.

For instance, following the increase in Monetary Policy Rate (MPR) to 26.75 per cent, by the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) in July, the stock market segment of the Nigerian Exchange Limited (NGX) depreciated by N1.3 trillion Week-on-Week (WoW) as investors take comfort in Treasury Bills and other fixed income securities.

All market indices, NGX Banking, Oil & Gas and Industrial Goods snowballed to the negative territory reflecting investors’ push for greener pastures. Although market experts said the hike in MPR to 26.75 per cent was targeted at further reducing liquidity from the banking system and jerking up cost of credit, the move impacted negatively on the manufacturing sector and, by extension, the equities market.

The banks’ recapitalization exercise which kicked off towards the end of March, 2024 was a boom for the financial services institutions and this pushed the banking index into the league of

‘golden’ stocks and contributed to the boost in stock deals during the eight months of the year.

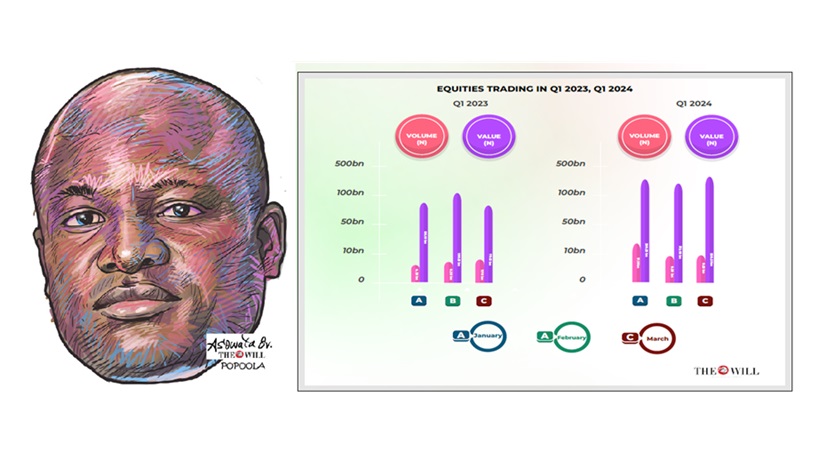

The Nigerian Exchange Limited (NGX) ‘s stock transaction figures for January to July 2024 were N941.62 billion higher than those seen in the same period of 2023. Total equity transactions in seven months to July 2024, stood at N3.095 t4illion as against N2.154 trillion obtained in July 2023.

Further analysis of the month-end performance of the NGX market indices showed the benchmark NGX All-Share Index (ASI) which inched up 171.66 (0.18%) points to close at 96,579.54, represented

a 1-week gain of 0.63%, a 4-week loss of 1.19%, but an overall yearto- date gain of 29.16%.

The NGX weekly report ended 30 August, showed that a total turnover of 2.821billion shares worth N53.048 billion in 50,488 deals was traded in the week by investors on the floor of the Exchange, in contrast to a total of 5.641 billion shares valued at N33.052 billion that exchanged hands last week in 42,006 deals.

The Financial Services Industry (measured by volume) led the activity chart with 1.857 billion shares valued at N15.825 billion traded in 19,937 deals; thus contributing 65.82% and 29.83% to the total equity turnover volume and value respectively.

The Oil and Gas Industry followed with 288.807 million shares worth N11.302 billion in 9,365 deals. The third place was the Services Industry, with a turnover of 177.666 million shares worth

N437.174 million in 3,604 deals.

The Nigeria’s equities market launched into the 2024 trading year on a robust enthusiasm. Aside from coinciding with the second anniversary of the demutualization of the Nigerian Exchange (NGX) Group in March 2021, the positive sentiment during the period was underscored by the change of leadership at the NGX Group.

Mr Temi Popoola was announced as the Acting Group Managing Director/Chief Executive Officer (GMD/CEO) effective January 2024. He replaced Oscar Onyema. In the same vein, Jude Chiemeka

took over from Popoola as Acting CEO of NGX Limited.

Like a team powered by the elevated furnace of good fortune, the NGX began to move on the bullish territory in a consistent, spectacular way, as the local bourse furthered its rally into 2024,

rising by 1.63 percent on January 2, the first trading day of the new year.

Sam Diala is a Bloomberg Certified Financial Journalist with over a decade of experience in reporting Business and Economy. He is Business Editor at THEWILL Newspaper, and believes that work, not wishes, creates wealth.